Free-Market Capitalism, Interpersonal Trust, and Trust in Political Institutions: A Multilevel Empirical Analysis, 1994–2014

скачать Авторы:

- de Soysa, Indra - подписаться на статьи автора

- Jakobsen, Tor Georg - подписаться на статьи автора

- Holum, Marthe - подписаться на статьи автора

Журнал: Journal of Globalization Studies. Volume 8, Number 2 / November 2017 - подписаться на статьи журнала

Trust is important in terms of achieving economic efficiency, as it reduces the need for costly systems of supervision and control with regards to transactions in a society. Employing data from the World Values Survey and the European Values Study 1994–2014 in combination with country-year data on the degree of economic freedom, we examine the propositions in multilevel analyses. We find very little effect either way between the degree of economic freedom and interpersonal trust and trust in political institutions. However, western countries benefit from greater economic freedom in terms of increasing trust. While previous research might be putting too great an emphasis on free markets for generating trust, we find no support for the proposition suggesting that greater economic freedoms in recent years reduce societal trust generally, or in political institutions, particularly in the West.

Keywords: social trust, capitalism, economic freedom, globalization.

Introduction

The debate on capitalism's effect on society has a long and illustrious pedigree going back to Adam Smith and his critics, including Karl Marx and others. The recent debates about globalization and the consequences of the rapid spread of neoliberal economic policies have once again raised interest in the issue of socio-political development under conditions of capitalism (Held and McGrew 2007; Iversen 2008; Rodrik 1997; Stiglitz 2002). Indeed, liberal policies towards trade and capital openness as well as migration are questioned on the basis of what they apparently mean for ‘social capital’ within countries (Putnam 2007; Rodrik 1998). Social capital, or the level of interpersonal and institutional trust, is viewed as a major determinant of economic and political success (Putnam 1993; Woolcock 1998). If capitalism is an assault on communitarian values and collective goods, such as welfare, equality, and social justice as some claim (UNRISD 1995), then we should be able to observe that in terms of the level of generalized trust within a society. This study will empirically assess how people view other people (interpersonal trust) and how they view their political institutions (political trust) under conditions of neoliberal economic policies by utilizing individual responses on questions pertaining to trust ascertained from four waves of the World Values Survey (WVS) covering 98 countries. We use multilevel statistical techniques that simultaneously assess individual- and country-level characteristics, holding constant several confounding factors.

The Economy and Trust

From whence trust in society originates is a debated topic. For some, trust is generated by socio-cultural factors deeply rooted in religion and history (Putnam 1993). For others, trust can be generated by political and economic institutions where cultural and institutional factors are not mutually exclusive (Jackman and Miller 2005; Rose-Ackerman 2001). Interpersonal trust and trust in political institutions are also different concepts, with different origins (Kaase 1999). Interpersonal trust can be described as relating more to an individual phenomenon, influenced by individual characteristics (‘trusting’, or ‘non-trusting’ personal characteristics) affecting one's immediate experiences relating to other people. Trust in political institutions, on the other hand, seems to be more influenced by perceptions of how well the political system works (Newton 2001). Individual level variables, including personal trust, have relatively little explanatory power in the analysis of trust in political institutions (Listhaug and Wiberg 1995; Kaase 1999; Newton and Norris 2000). Aggregated interpersonal trust at the national level is, however, closely related to institutional trust. If institutions prevent cheating then people will trust other people more and trust their institutions. National level interpersonal trust, however, is a necessary, but not sufficient condition for institutional trust. High levels of interpersonal trust and social capital do not automatically result in high levels of trust in national institutions, but the effect on institutional trust is mediated by effective political institutions (Newton 2001). For example, the effectiveness of institutions such as the civil service consists of both an output and a process nature. Van Ryzin (2011) suggests that citizens' trust in civil services is influenced by the perception of fair, non-corrupt processes more than in the final output of services per se.

At least one recent empirical study shows that economic freedom enhances general trust in a society, even after adjusting for endogeneity by instrumenting historical and cultural factors with good institutions (Berggren and Jordahl 2006).1 Our study is different, in that we use multiple levels, country- and individual-level observations, when assessing the relationship between economic freedom and generalized trust. Indeed, the freedom to transact could produce particularistic trust among certain individuals, such as buyers and sellers, but it may not necessarily result in wider circles of trust. We also assess how economic freedom can affect trust in political institutions, assuming it can affect citizens' perceptions of how well the political system is working – for example, by the perception of more fair processes and satisfactions with outcomes. This allows us to answer more directly whether more capitalistic economic institutions erode communitarian values and state-society bonds vital for the generation of broader social capital, an issue that have generated considerable debate among scholars of globalization (Held and McGrew 2007; Rodrik 1997).

The issue of free market capitalism and social harmony was first addressed by classical liberals, such as Adam Smith, David Ricardo, and Bernard Mandeville, who argued that individuals in pursuit of self-interested goals serve a higher social purpose ‘as if by a hidden hand’ (Stilwell 2006). They argued in favor of free markets for achieving social cooperation, rather than simply rely on appeals to morality and Christian ethics. Self-interested individuals cooperate because it is good for the ‘bottom line’, which supplanted parochial corporate affiliations, such as ethnicity and religion, raising the value of individual rights over collective rights. The rights of individuals guaranteed by institutions thus allow broader social capital because parochial barriers breakdown. Classical liberals argued that harmony stems fundamentally from expected gains from cooperation rather than from religious ethics, or some inherent feelings of sympathy for fellow beings preached from pulpits. In its very essence, arguments about the superiority of capitalism over the dominant economic system of the time, mercantilism, was due to the ability of markets to create and distribute goods and services (wealth) more efficiently because of the combined acts of self-interested individuals.

Capitalism is marked by the means of production being owned by and secured for individuals and by its expansionary tendency, since the desire for profit drives investment, which in turn benefits society by breaking down parochial ascriptive ties. The division of labor is seen as one of the key mechanisms by which people will learn the habits of cooperation and trust, particularly by banding in associations that would allow collective interests to be realized. Durkheim, for example, saw primitive modes of production leading to ‘mechanical solidarity,’ which would be replaced by more ‘organic’ forms of solidarity as the division of labor became more complex (Smelser and Swedberg 1994). As markets expand, thus, spheres of peace and prosperity might also expand as liberals suggested through the social cooperation brought about by the division of labor. Thus, a social-welfare maximizing ruler would be one who interfered least in the workings of markets. At a minimum, the state should provide public works that enhance the operation of and the expansion of markets (Stilwell 2006). Free-market environments also lead to the cementing of the rule of law because commercial activity required a contract-rich environment.

Such arguments were expanded by political philosophers, such as Immanuel Kant, John Stuart Mill, and Norman Angell, who viewed the expansion of trade, or the ‘commercial spirit,’ as the triumph of exchange and civility over plunder and predation. Since markets promote alternative bases of power that check the power of rulers and monopolists, and since talent rather than privilege determines economic success, people will cooperate and form associations that generate social capital for overcoming collective dilemmas, such as the abuse of power. Contrarily, the politics of privilege and rent seeking by elites are environments in which trust is likely to be constrained. Consider the following observation, made in the 1830s by Alexis de Tocqueville, an early theorist of social capital and a keen observer of how democracy, rather than chaos, was taking root in the newly formed United States of America:

You have some difficulty in understanding how men so independent do not constantly fall into the abuse of freedom. If on the other hand, you survey the infinite number of trading companies in operation in the United States … you will comprehend why people so well employed are by no means tempted to perturb the state, nor to destroy the public tranquility by which they all profit (de Tocqueville 1840).

Much later, others also saw the advance of state socialism as a threat to individual liberty and civic culture (Hayek 1944). Indeed, several recent empirical studies find that more capitalistic countries tend to have better outcomes on economic development and peace and harmony, including less international and civil war, greater democracy, and less political repression, suggesting at least some evidence for a connection, albeit rather indirectly, between more capitalistic economic systems and greater generalized trust, ceteris paribus (Bhagwati 1999; de Soysa and Fjelde 2010; de Soysa and Vadlamannati 2013; Gartzke 2007; Gwartney and Lawson 2005; Iversen 2008).

Critics of capitalism, such as Marxists and other proponents of critical theory, capitalism is viewed as too anarchical, leading to winner-take-all forms of economic activity. Critics of capitalism see free markets empowering the owners of capital, who apparently exploit labor (Saunders 1995). The nature of the production and reproduction of capitalism creates distinct classes where capital becomes concentrated among a few. These classes will ultimately compete (even clash) over the redistribution of the social surplus. Such explanations of conflict have a long pedigree that views European revolutions as the desire of the poor to emancipate themselves from the shackles of despotism and bourgeois exploitation (Przeworski 1990). Indeed, rather than markets expanding under capitalism, the critics argue that capitalism bred class warfare and instability, where there was a tendency towards the development of a leisure class that would indulge in conspicuous consumption and constant underinvestment, leading to a parasitic class living off the sweat of labor (Stilwell 2006). Under these conditions of class inequality and the exploitation of labor by capital, capitalism would ultimately breed the destruction of social capital and egalitarian communitarian values (Polanyi 1944). Indeed, Durkheim, who saw virtue in the division of labor also argued that unregulated markets without the proper mechanisms of developing social solidarity could lead to the alienation of individuals and lead to a state of social anomie. Following Marx, others also warned about the social ills of free-market capitalism because they saw it as an assault on building equity and social peace. As Karl Polanyi (1944: 171) wrote, ‘to separate labour from other activities of life and to subject it to the laws of the market was to annihilate all organic forms of existence and to replace them by a different type of organization, an atomistic and individualistic one.’

The older, macro arguments about the effects of capitalism and free markets on social capital have resurfaced in the debates on globalization. Even orthodox economists, such as Joseph Stiglitz and Dani Rodrik, argue that globalization may have gone too far by constraining states from acting in the interests of its societies, preventing effective compensation of the losers from the boom and bust cycles of free markets. Since the spread of neoliberal ideas of free markets have swept the globe in recent decades, they argue that states are engaged in a ‘race to the bottom’ to lower social and environmental standards to please ‘footloose’ capital. Under such conditions, communitarian interests are likely to be disregarded, leading to social disarray (Rodrik 1997; Stiglitz 2002; UNRISD 1995). Clearly, as the preceding discussion suggests, the debates about capitalism and social capital have resurfaced throughout the ages, and there is little systematic empirical evidence for judging either way. Our study adds to the empirical literature by using information at multiple levels, the individual level and country-survey – year level, and the country level. By collapsing all five waves of the World Values Survey (1981–2007), we test sundry country-level variables safely by increasing the degrees of freedom given the large number of individual-level observations. This setup allows us to perform a better test than simply an aggregated cross-country test of the connections between free-market conditions and generalized trust in societies.

The Issue of Causality

It is necessary to highlight the issue of causality with regard to the link between market economy and trust. An association is not necessarily a causal association. To address this question we must answer three well-known questions, in addition to the question of correlation (which we test in our models).

First, can we argue that there is a credible causal mechanism that connects a market economy to trust? To answer this, we would have to evaluate the underlying mechanisms suggesting such a causal connection. In more detail, what is it specifically that makes a country with greater free-market conditions to cause citizens to be more trusting of each other? Another interpretation could be that free market and trust are mutually reinforcing. Second, is there a possibility that greater trust among people could lead to greater free-market conditions? Thirdly, it be that a third, unidentified factor, is really the underlying cause, and that any observed relationship between free markets and trust is spurious? Most dependent variables are caused by more than one independent variable. Thus, we have included two country-survey-year- and one country-level control on the right-hand side of the regression equation to control for any spurious effect.

If we examine the first question above, our discussion of the propositions suggested by Adam Smith and others provides the answer. The dealing of self-interested individuals and the self-regulating nature of the marketplace forces people to respect each other, thereby leading to increased trust. The formation of the European Union provides a vivid example. Increased trade and economic interdependence generated by the Schumann Plan led to the political union among former enemies that were deeply distrustful of each other. Regarding the question of a possible reverse causality, however, it might be equally plausible that social trust is what generates the conditions conducive to free market capitalism. Gierke (1868) suggests that the history of the joint stock market companies can be traced back to medieval Italy and banca di S. Giorgio (1407–1816) as well as the Vereenigde Oost-Indische Compagnie in the Dutch Republic.

Regardless of the true origin, today's free market has followed the trajectory of the English variant of the joint-stock company. This type incorporated an important idea that was not present in the earlier Italian version, namely the Germanic conception of corporateness. The English joint-stock company was a product of medieval collectivism designed to concentrate means and powers to the adventurers and explorers who set out to discover new trade routes (Schmitthoff 1939). In other words, a sense of community that allowed for the pursuit of a common good laid the grounds for the English version of capitalism. This would imply that the causal direction could go both ways, some sort of community feeling and trust particular for medieval England was in place for the joint-stock company to establish, and similar mechanisms was at play with regard to the Dutch version, yet not with the Italian, which was more an association of individual bondholders. However, this Anglo-Saxon version of capitalism spread to other cultures that did not necessarily originally embrace the concept of corporateness in the same degree as the northern Germanic countries of Europe. In those cases, the concept of a free market economy can be argued to be more exogenous than when introduced in what we today denote as Western societies. Whatever the origins of capitalism, any positive association between greater free-market conditions and higher trust would undermine arguments linking higher liberalization with ‘societal disarray’ as many critics of globalization claim. This should matter most when considering the Western countries, which have been the most exposed to global economic forces in the past several decades.

Data and Empirical Strategy

To gauge the relationship between economic freedom and individual trust, we combine survey data with country-level observations. Our individual level data are from the World Values Survey (WVS 2015) and the European Values Study (EVS 2015).2 We use data from 1994–2014 time-periods and 98 countries. Our data comes from four waves of surveys (1994–1998, 1999–2004, 2005–2009, and 2010–2014). There are three levels in the data: (1) individuals; (2) country-survey-years, and (3) countries. We wish to test the effect of a variable coded at the country-year level on individual attitudes. Thus, we rely on multilevel modeling. We investigate three dependent variables: personal trust (0–1)3, trust in decision makers (1–7)4, and trust in civil service (1–10).5 For the models on personal trust, we use logistic multilevel modeling, for the models on trust in parliament and trust in civil service we employ linear multilevel modeling.

Even though our main variable of interest is at the country-year level, our multivariate analysis includes both micro and macro variables. We have included relevant individual variables from previous studies that did not have substantial missing observations. These include woman (dichotomous variable where women have the value 1), age, income (a ten-point scale showing total household income), and higher education (dichotomous variable where those with higher education have the value 1).

At the country-year level, we have our theoretically important variable ECONO-MIC FREEDOM (Heritage Foundation 2016). This index is composed of ten quantitative and qualitative factors that can be grouped into four categories: rule of law, limited government, regulatory efficiency, and open markets.6 As level-2 controls, we include per capita GDP and population size (World Bank 2016). At the country level (level-3), we control for western country, which denotes whether or not the country belongs in the Western civilization (Huntington 1996).

Results

We ran a total of six models, two for each of the three dependent variables, which are presented in Table 1. The first includes those relevant individual level controls, our main country-survey-year level measure economic freedom, and control for living standard and population, as well as the country-level measure capturing whether or not a country was a western country. Our primary interest is related to the relationship between capitalism and trust and the effect of macro-variables in terms of their impact on answers at the individual level. Starting with the measure of economic freedom, we find a small negative effect of economic freedom on the likelihood that individuals trust each other, particularly when a dummy variable for Western countries is included. Being a Western country increases trust. There is also a positive effect of higher income on individual trust. Substantively, the log odds of decreasing trust given a unit increase of economic freedom is extremely small (0.99) – or roughly 1 % reduction. It is important to remember that the standard errors of the higher-level coefficients are calculated based on the N of their respective levels (which is much lower than the level-1 N), thus making it much harder to produce significant results. This is, however, the correct way of calculating the standard errors.

Table 1

Linear multilevel regressions on trust

| Personal (0–1) | Personal (0–1) | Decision makers (1–7) | Decision makers (1–7) | Civil service (1–10) | Civil service (1–10) | |

| Constant | –4.243** (0.685) | –2.889*** (0.933) | 3.816*** (1.162) | 3.997*** (1.198) | 4.161*** (1.306) | 4.686 (1.370) |

| Level-1 variables | ||||||

| Woman | 0.052*** (0.016) | –.044*** (0.009) | 0.007 (0.016) | 0.007 (0.016) | 0.081*** (0.021) | 0.081*** (0.021) |

| Age | 0.005*** (0.000) | 0.003*** (0.000) | 0.005*** (0.001) | 0.005*** (0.001) | 0.005*** (0.001) | 0.005*** (0.001) |

| Income | 0.068*** (0.003) | 0.055*** (0.002) | 0.016** (0.007) | 0.016** (0.007) | 0.030*** (0.008) | 0.030*** (0.008) |

| Higher education | 0.379*** (0.012) | 0.342*** (0.012) | –0.028 (0.032) | –0.028 (0.032) | –0.048 (0.037) | –0.048 (0.037) |

| Level-2 variables | ||||||

| Per capita GDP† | 0.108*** (0.025) | 0.040 (0.055) | –0.057 (0.061) | –0.062 (0.062) | 0.041 (0.072) | 0.028 (0.071) |

| Population† | 0.106** (0.033) | 0.077* (0.045) | 0.038 (0.065) | 0.034 (0.065) | 0.039 (0.072) | 0.027 (0.073) |

| Economic freedom | –0.006** (0.003) | –0.010 (0.007) | –0.007 (0.005) | –0.009* (0.005) | –0.001 (0.009) | –0.004 (0.009) |

| Level-3 variable | ||||||

| Western country | 0.640*** (0.189) | –1.604* (0.956) | –0.234 (0.191) | –1.183 (0.814) | 0.076 (0.218) | –2.318* (1.188) |

| Cross-level interact | ||||||

| West* Economic free | 0.037*** (0.014) | 0.014 (0.013) | 0.035** (0.018) | |||

| Variance | ||||||

| Level-1 variance | – | – | 2.169 (0.066) | 2.169 (0.066) | 3.831 (0.120) | 3.831 (0.120) |

| Level-2 variance | 0.284 (0.058) | 0.366 (0.070) | 0.134 (0.026) | 0.134 (0.026) | 0.118 (0.021) | 0.113 (0.021) |

| Level-3 variance | 0.288 (0.019) | 0.170 (0.023) | 0.612 (0.123) | 0.608 (0.122) | 0.840 (0.167) | 0.834 (0.165) |

| Level-1 N | 259,832 | 259,832 | 213,830 | 213,830 | 172,365 | 172,365 |

| Level-2 N | 216 | 216 | 179 | 179 | 144 | 144 |

| Level-3 N | 98 | 98 | 86 | 86 | 79 | 79 |

| Log Likelihood | –133,026 | –132,970 | –404,361 | –404,361 | –374,626 | 374,624 |

Note: The standard errors are in parentheses. ***p<.01; **p<0.05; *p<.10 (two-tailed test) † the variable is log transformed. Maximum likelihood estimation (MLE) is employed.

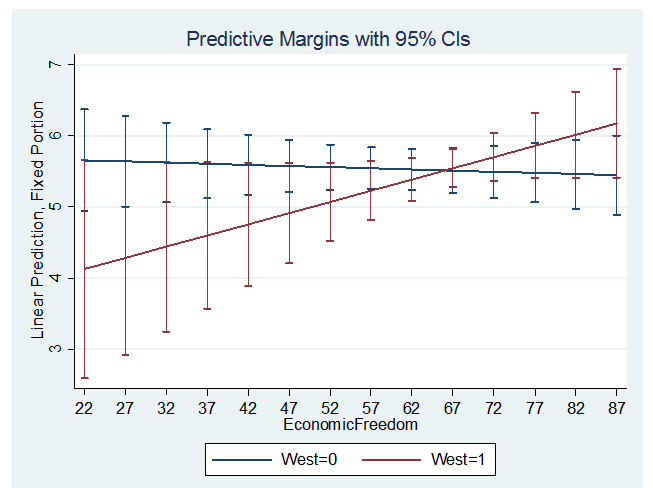

Next we compare the interactive term between western country and economic freedom.7 In column 3, the product of western country and economic freedom is positive and statistically significant. Notice, however, that western country alone is negative and statistically significant when economic freedom is zero. This result holds when we test both personal trust and institutional trust (see Fig. 1). These results suggest that economic freedom does indeed play a role in producing greater trust among the Western societies, whereas Western societies lacking economic freedom show lower levels of trust. The results in Table 1 taken together do not support the proposition that greater free-market capitalism drives a ‘race to the bottom’ in terms of how people trust each other and their institutions of state.

Fig. 1. Interaction between west and economic freedom, including 95 % confidence intervals

Conclusion

Interpersonal trust and trust in political institutions are key ingredients for economic and political success of a society. There has been a long and contentious debate about how capitalist institutions and market principles either generate or degrade social and political trust. The issue seems to be an empirical one. The recent debates on the effects of globalization have brought the issue to the fore once again. Many see that the growth of market principles around the world as a menace to communitarian values, resulting in the breakdown of communitarian values, such as mutual trust among citizens and trust between the governed and the government. Using multilevel estimating techniques and data from the World Values Survey and European Values Study, our results show some mixed effects. There seems to be little direct effect of economic freedom on trust in general, yet, we do find that in Western countries, where capitalism seems most advanced, there is a positive effect of capitalism on trust. It might be the case that issues of trust are generally independent of cultural and institutional factors, despite the large amount of theorizing over the years, particularly by sociologists, of the central place of economic factors as explanations for how individuals relate to one another and their political institutions. In so far as we gauge the effect of greater economic freedom among the Western countries, free markets seem to increase, not reduce, social trust.

NOTES

1 See Berggren and Jordahl (2006) for an excellent discussion of the many microeconomic perspectives on how economic freedom might stimulate wider trust in society.

2 More information about WVS can be found at URL: http://www.worldvaluessurvey.org. These datasets are made available through the Norwegian Social Science Data Services (NSD). Neither Ronald Inglehart, WVS, or NSD are responsible for the analysis or interpretations made in this article. More information about the EVS can be found at URL: http://www.europeanvaluesstudy.eu.

3 Respondents have answered the statement ‘Most people can be trusted’ with the answer categories ranging from 0 ‘Can't be too careful’ to 1 ‘Most people can be trusted’.

4 This variable is composed of two measures: one measuring how much confidence the respondents have in parliament, and one measuring how much confidence they have in the government. Both variables range from 1–4, where the answer categories go from 1 ‘None at all’ to 4 ‘A great deal’. We have performed a factor analysis and reliability analysis (alpha 0.790), and following this, collapsing these two variables into a scale.

5 This variable is composed of three measures: one measuring how much confidence the respondents have in the civil service, one measuring confidence in the justice system, and one measuring confidence in the police. All variables range from 1–4, where the categories go from 1 ‘None at all’ to 4 ‘A great deal’. We have performed a factor analysis and reliability analysis (alpha 0.722), and following this, collapsing these three variables into a scale.

6 Rule of law includes property rights and freedom from corruption, limited government includes fiscal freedom and government spending, regulatory efficiency includes business freedom, labor freedom, and monetary freedom, and open markets includes trade freedom, investment freedom, and financial freedom. These ten indicators are graded on a scale from 0–100, and the overall score is the average of these (Heritage Foundation 2016).

7 The N of the standard errors for the interaction term are calculated using the level-2 N.

REFERENCES

Berggren, N., and Jordahl, H. 2006. Free to Trust: Economic Freedom and Social Capital. Kyklos 59 (2): 141–169.

Bhagwati, J. 1999. Economic Freedom: Prosperity and Social Progress. Paper presented at the Conference on Economic Freedom and Development. Tokyo, June 17–18.

EVS 2015. European Values Study Longitudinal Data File 1981–2008 (EVS 1981–2008). GESIS Data Archive, Cologne. ZA4804 Data file Version 3.0.0, doi:10.4232/1.12253.

Gartzke, E. 2007. The Capitalist Peace. American Journal of Political Science 51 (1): 166–191.

von Gierke, O. F. 1868. Das deutsche Genossenschaftsrecht [The German Companionship]. 1st vol. Graz: Akademische Druck-u. Verlagsanstalt.

Gwartney, J., and Lawson, R. 2005. Economic Freedom in the World 2003: The Annual Report. Vancouver: The Fraser Institute.

Hayek, F. A. 1944. The Road to Serfdom. Chicago, IL: University of Chicago Press.

Held, D., and McGrew, A. 2007. Globalization Theory: Approaches and Controversies. Cambridge: Polity.

Heritage Foundation 2016. 2016 Index of Economic Freedom. URL: http://www.heritage. org.

Huntington, S. J. 1996. The Clash of Civilizations and the Remaking of World Order. New York: Simon & Schuster.

Iversen, T. 2008. Capitalism and Democracy. In Weingast, B., and Wittman, D. (eds.), Oxford Handbook of Political Economy (pp. 601–623). Oxford: Oxford University Press.

Jackman, R. W., and Miller, R. A. 2005. Before Norms: Institutions and Civic Culture. Ann Arbor, MI: University of Michigan Press.

Kaase, M. 1999. Interpersonal Trust, Political Trust and Non-institutionalized Political Participation in Western Europe. West European Politics 22 (3): 1–21.

Listhaug, O., and Wiberg, M. 1995. Confidence in Political and Private Institutions. In Klingemann, H.-D., and Fuchs, D., (eds.), Citizens and the State (298–322). Oxford, UK: Oxford University Press.

Newton, K. 2001. Trust, Social Capital, Civil Society, and Democracy. International Political Science Review 22 (2): 201–214.

Newton, K., and Norris, P. 2000. Confidence in Public Institutions: Faith, Culture, or Performance? In Pharr, S. J., and Putnam, R. D. (eds.), Disaffected Democracies: What's Troubling the Trilateral Countries? (pp. 52–73). Princeton, NJ: Princeton University Press.

Polanyi, K. 1944. The Great Transformation: The Political and Economic Origins of Our Time. Boston, MA: Beacon.

Przeworski, A. 1990. The State and the Economy under Capitalism. London: Routledge.

Putnam, R. 1993. Making Democracy Work: Civic Traditions in Modern Italy. Princeton, NJ: Princeton University Press.

Putnam, R. 2007. E Pluribus Unum: Diversity and Community in the Twenty-First Century: The 2006 Johan Skytte Prize Lecture. Scandinavian Political Studies 39 (2): 137–174.

Rodrik, D. 1997. Has Globalization Gone Too Far? Washington, DC: Institute for International Economics.

Rodrik, D. 1998. Why Do More Open Countries Have Bigger Governments? Journal of Political Economy 106 (5): 997–1032.

Rose-Ackerman, S. 2001. Trust, Honesty and Corruption: Reflections on the State-Building Process. Archives of European Sociology 41 (3): 526–570.

Saunders, P. 1995. Capitalism: A Social Audit. Buckingham: Open University Press.

Schmitthoff, C. M. 1939. The Science of Comparative Law. Cambridge Law Journal 7 (1): 94–110.

Smelser, N. J., and Swedberg, R. 1994. The Sociological Perspective on the Economy. In Smelser, N. J. and Swedberg, R. (eds.), The Handbook of Economic Sociology (pp. 3–26). Oxford: Oxford University Press.

de Soysa, I., and Fjelde, H. 2010. Is the Hidden Hand an Iron Fist? Capitalism and the Onset of Civil War, 1970–2005. Journal of Peace Research 47 (3): 287–298.

de Soysa, I., and Vadlamannati, K. C. 2013. Do Pro-Market Economic Reforms Drive Human Rights Violations? An Empirical Assessment, 1981–2006. Public Choice 155 (1): 163–187.

Stiglitz, J. E. 2002. Globalization and Its Discontents. London: W. W. Norton.

Stilwell, F. 2006. Political Economy: The Contest of Economic Ideas. 2nd ed. Oxford: Oxford University Press.

de Tocqueville, A. 1840. De La Démocratie en Améruque [On Democracy in America]. Paris: Librairie de Charles Gosselin.

UNRISD. 1995. States if Disarray: The Social Effects of Globalization. Geneva.UNRISD.

Van Ryzin, G. G. 2011. Outcomes, Process and Citizens' Trust of Civil Servants. Journal of Public Administration Research and Theory 21 (4): 745–760.

Woolcock, M. 1998. Social Capital and Economic Development: Towards a Theoretical Synthesis and Policy Framework. Theory and Society 27 (2): 151–208.

World Bank. 2016. World Development Indicators (www.data.worldbank.org).

WVS. 2015. World Values Survey 1981–2014 Longitudinal Aggregate v.20150418. World Values Survey Association (www.worldvaluessurvey.org). Aggregate File Producer: JDSystems, Madrid Spain.